Dive Brief:

- More than 15,000 stores could shutter in 2020, far surpassing 2019’s record 9,548 closures, according to an emailed report from Coresight Research.

- Coresight analysts also anticipate more retailers will file for bankruptcy this year, and that more companies could end up liquidating entirely in Chapter 7.

- Accelerating closures and bankruptcies in 2020 is the coronavirus pandemic, which Coresight CEO Deborah Weinswig said in the report will “provide a sharp shock to physical retail.”

Dive Insight:

Around 100 retailers have moved to shut all, or at least many, of their stores temporarily as the country responds to rapidly expanding cases of COVID-19 domestically. According to Bloomberg data, more than 47,000 stores closed in a 10-day period — an unprecedented disruption of the entire industry.

“We anticipate that some of the retailers that have recently announced temporary store closures — including some well-known names — will never reopen their doors,” Weinswig said in the Coresight report. “The enforced closures will hit retailers with limited cash/low liquidity, those already pinched badly by structural shifts and company-specific weaknesses, and those which are unable to translate whatever remaining consumer demand there is into sales on their websites.”

The ranks of distressed retailers were already challenged going into 2020. At the outset of the year, the American consumer seemed healthy and relatively optimistic despite last year’s trade wars. But many retailers saw sales decline in the fourth quarter — a make or break period that contributes outsized fractions of a retailer’s cash and annual profits.

The closures create an immediate need for cash and liquidity. Companies that are highly leveraged or were going through cash crunches because of falling sales are in even more precarious positions. For those that fail and are forced to liquidate entirely in bankruptcy, they could be outsized contributors to the total store count, as they were in 2019.

But a wide cross-section of retail is in for a tough time as governments order residents to stay home and stores to close, or as consumers voluntarily self isolate to avoid catching or spreading COVID-19.

Weinswig said that the impact “will be especially hard on retailers of discretionary goods, with apparel retail, department stores, home and home improvement retail and electronics and appliances retail set to be significantly affected.” That falling demand for discretionary retail could be a driving force of permanent store closures later in the year.

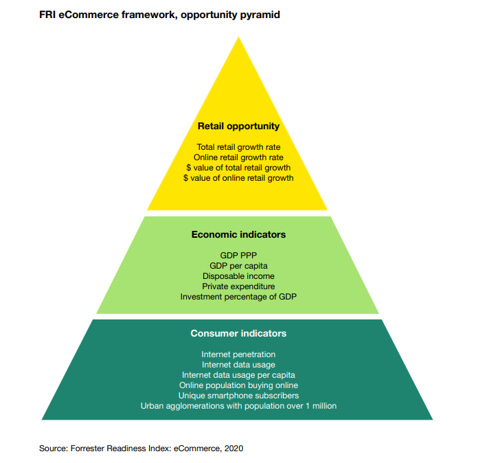

More, consumers may not ever return to their previous shopping habits as they turn to e-commerce and mass merchants for an extended period. A looming recession could also lead consumers to pull back spending, which could deal a second blow to retailers. Alternatively, consumers could return to stores when the pandemic concerns have calmed, as a way to get out of the house.