Dive Brief:

-

After a battle to keep stores open in February, Modell’s filed for Chapter 11 bankruptcy in New Jersey on Wednesday, with plans to liquidate its entire 134-store footprint beginning Friday. The company employs roughly 3,600 employees, nearly 3,300 of which are hourly.

-

The company is also working with creditors to explore a potential sale of some or all of its assets or an equity investment, according to a company press release. That includes Modell’s intellectual property, according to court documents.

-

RBC Capital Markets was hired to pursue a sale of Modell’s as a going concern in January, but negotiations with a “potential bidder” fell through on Tuesday. News reports had pointed to Denver-based athletic retailer JackRabbit as a possible acquirer.

Dive Insight:

Just over two weeks ago, Modell’s drew up plans to shutter 19 stores and seek outside investment to help save the company from filing for bankruptcy. That plan came up short.

It marks the end of an era for a retailer that has dominated the Tri-State area for years and has been in operation since 1889. In recent weeks, CEO Mitchell Modell himself has “negotiated tirelessly” with vendors and landlords, and “undertook herculean efforts to obtain rent concessions,” according to court documents.

Modell told Retail Dive last month that in the past year the retailer has been plagued by a series of unfortunate events that started with a Wall Street Journal article about the company hiring restructuring advisers and wound up costing it needed merchandise from vendors, as well as a downgrade. Modell’s bankruptcy filing was a year to the day after the Wall Street Journal article broke.

But it seems the retailer has been in a state of precarious financial stability longer than that. According to court documents, Modell’s first hired Berkeley Research Group in the summer of 2017, then rehired the consulting firm for financial and consulting services two years later, and then again just two months ago, in January.

RBC was also engaged to pursue a sale of Modell’s. The firm talked to 14 strategic buyers in recent weeks, but plans ultimately fell through. This wasn’t the first time Modell’s went looking for a buyer. RBC also helped Modell’s pursue a sale in early 2019, talking to 25 potential buyers, which amounted to nothing once the retailer managed to renegotiate some store leases and acquire more capital.

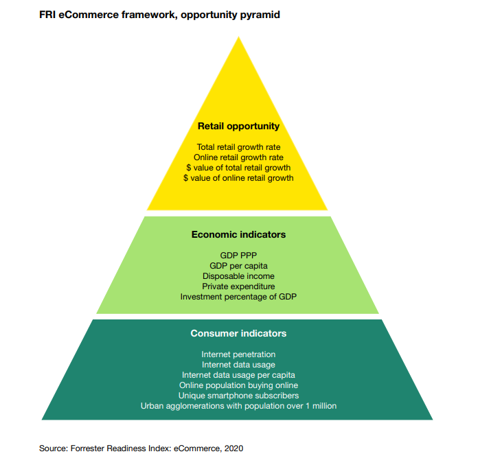

Like many others that have filed for bankruptcy in recent days, the spectre of e-commerce has risen over Modell’s bankruptcy, with Chief Restructuring Officer Robert Duffy, a managing director at BRG, pointing to the shift away from brick and mortar as a factor in the retailer’s downfall. Among other “adverse market trends,” Modell’s was besieged by increased competition from big-box and specialty players, as well as a decline in youth sports team participation.

The sporting goods retailer also pointed to those that have fallen before it, including Sports Authority, Sport Chalet and Eastern Mountain Sports, as evidence of the challenging environment. Added to that were short-term challenges like a warm winter, underperforming professional sports teams, which led to fewer sales of licensed goods, and inventory disruptions when vendors got spooked by the Wall Street Journal’s reporting.

“Over the past year, we evaluated several options to restructure our business to allow us to maintain our current operations. While we achieved some success, in partnership with our landlords and vendors, it was not enough to avoid a bankruptcy filing amid an extremely challenging environment for retailers,” Modell said in a statement, thanking vendors and landlords for their support. “This is certainly not the outcome I wanted, and it is one of the most difficult days of my life. But I believe liquidation provides the greatest recovery for our creditors.”